Unlock Efficiency & Security: Empowering Your Financial Institution with WhatsApp Flows

In today's digital age, convenience and security are paramount for customer financial experiences. WhatsApp Banking has emerged as a popular solution, but WhatsApp Flows unlock an entirely new level of efficiency and user engagement. These innovative flows transform simple messaging into a powerful tool for streamlining account management, loan applications, and more.

This article dives deep into how WhatsApp Flows can revolutionize your financial institution's WhatsApp Banking strategy. We'll explore how they:

- Simplify Data Entry with Intuitive Flows: Structured flows guide users through tasks, simplifying data entry and reducing errors.

- Fortify Your Security Posture with Encrypted Flows: User passwords are hidden from chat history, minimizing the risk of exposure.

- Effortless KYC Compliance with Streamlined Workflows: Automated data validation within WhatsApp Flows facilitates efficient KYC (Know Your Customer) checks.

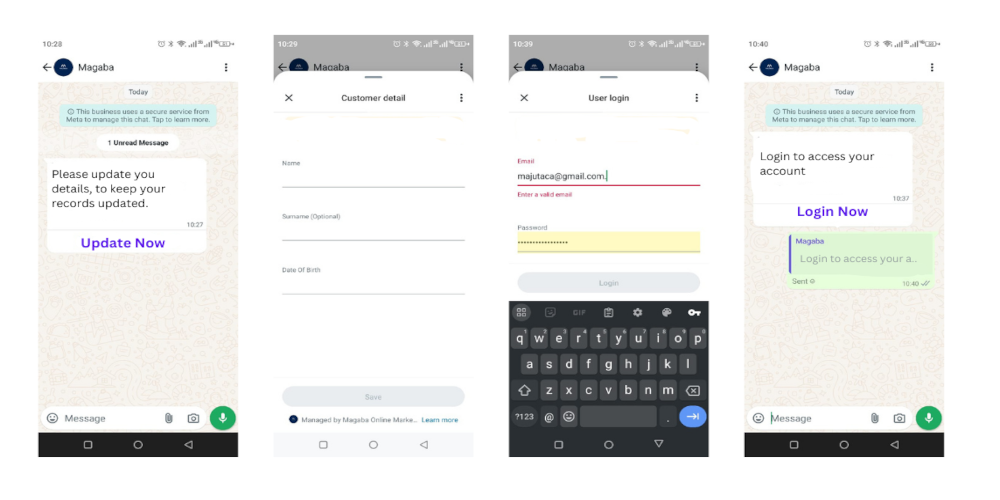

Simplify Data Entry with Intuitive Flows

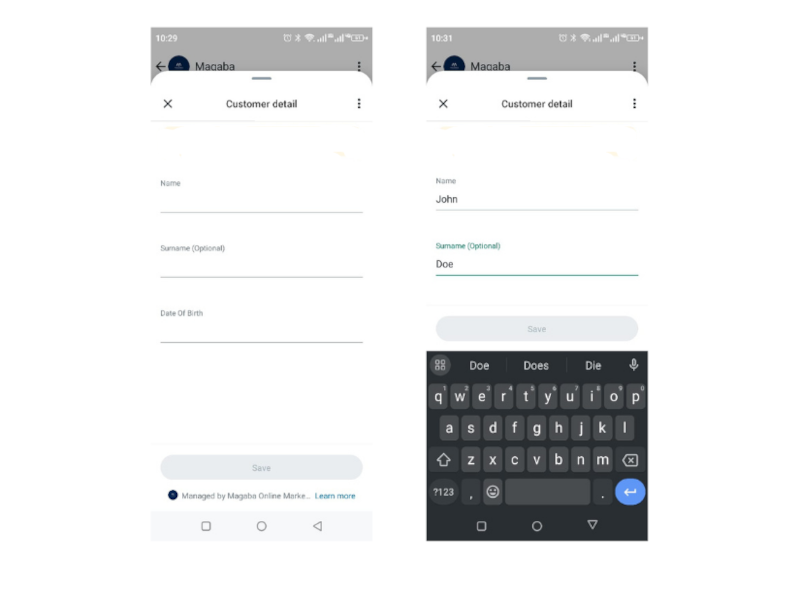

WhatsApp Flows eliminate the hassle of manual data entry for your customers. With a few taps, users can:

- Complete tasks seamlessly: Flows act as guided conversations, prompting users for information like name, surname, and date of birth in a clear and intuitive format.

- Avoid errors: Built-in data validation ensures users enter information correctly, minimizing frustration and wasted time.

- Receive instant feedback: If any errors occur, users are notified immediately and guided towards the correct format.

- Pre-Filled Forms: Integrate data from existing customer profiles to pre-populate certain fields in the KYC flow, further reducing customer effort.

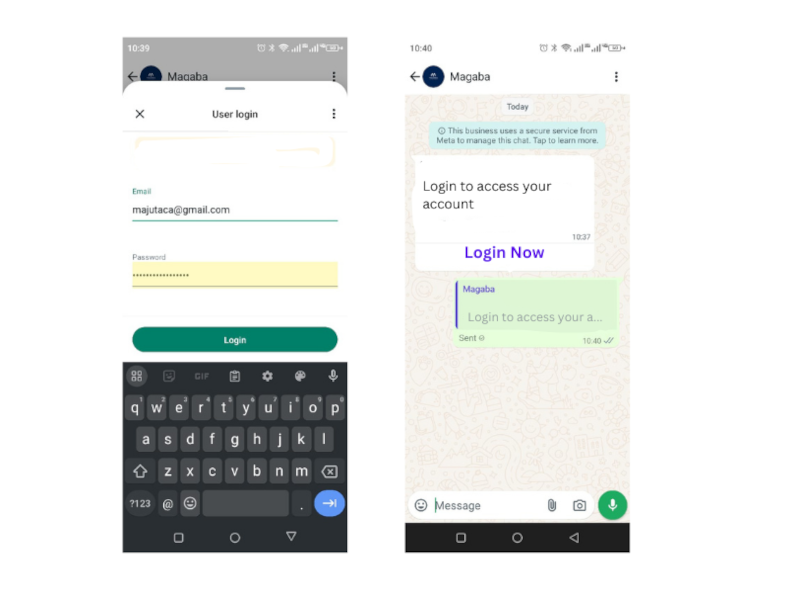

Fortify Your Security Posture with Encrypted Flows

WhatsApp Banking with Flows prioritizes the security of your customer's information. Here's how:

- Eliminate Password Exposure: Unlike traditional chat conversations, passwords are never displayed within WhatsApp Flows. This significantly reduces the risk of sensitive data being accidentally revealed or intercepted by unauthorized parties.

- Safeguard Data Transmission: WhatsApp Flows leverage end-to-end encryption, ensuring that all information exchanged between your customer and the bank remains confidential throughout the entire process. This encryption protects data in transit, preventing unauthorized access even if someone were to intercept the communication.

- Minimize Human Error: By automating data collection and validation, WhatsApp Flows reduce the potential for human error that could lead to security vulnerabilities.

Effortless KYC Compliance with Streamlined Workflows

Streamline your KYC (Know Your Customer) processes and ensure regulatory adherence with the power of WhatsApp Flows. Here's how they simplify compliance:

- Automated Data Capture and Validation: WhatsApp Flows guide users through the KYC process, prompting them to submit required information like name, address, and identification documents. Built-in validation checks data formats and ensures accuracy, reducing manual review time and minimizing errors.

- Reduced Manual Workload: By automating data collection and validation, WhatsApp Flows free up valuable staff resources previously dedicated to manual KYC checks. This allows your team to focus on more complex customer interactions and resolving exceptions.

- Enhanced Efficiency and Accuracy: The streamlined nature of WhatsApp Flows accelerates the KYC process, allowing you to onboard customers faster while maintaining a high level of accuracy. This translates to a smoother customer experience and improved operational efficiency.

The Future of Financial Interactions: Embrace the Power of WhatsApp Flows

The integration of WhatsApp Flows in WhatsApp Banking represents a transformative shift in how customers interact with their financial institutions. By offering a seamless user experience, robust security features, and a multitude of benefits, WhatsApp Flows are setting a new standard for convenient, secure, and efficient financial transactions. As the financial landscape continues to evolve, institutions that embrace innovative solutions like WhatsApp Flows will be well-positioned to:

- Thrive in a Customer-Centric Era: Deliver exceptional customer experiences that meet the ever-growing demand for mobile-first banking solutions.

- Enhance Security and Compliance: Safeguard sensitive information with robust features like end-to-end encryption and automated data validation.

- Boost Operational Efficiency: Streamline workflows, reduce manual tasks, and empower staff to focus on higher-value interactions with customers.

By taking a proactive approach and adopting cutting-edge solutions like WhatsApp Flows, financial institutions can unlock a new era of efficient, secure, and customer-centric banking in the digital age.

Unleash the Power of WhatsApp Banking: Request Your Free Demo Today

Ready to transform the way your customers interact with your financial institution? WhatsApp Flows offer a seamless and secure way to streamline communication, enhance security, and elevate the customer experience. Request Now!